How a Home Loan Calculator Can Assist You Quote Monthly Repayments Accurately

How a Home Loan Calculator Can Assist You Quote Monthly Repayments Accurately

Blog Article

Smart Loan Calculator Service: Enhancing Your Economic Computations

Imagine a tool that not only simplifies intricate lending calculations but likewise provides real-time understandings into your economic dedications. The smart financing calculator option is created to simplify your financial estimations, offering a smooth means to analyze and prepare your finances.

Advantages of Smart Loan Calculator

When analyzing financial options, the advantages of making use of a clever financing calculator become noticeable in facilitating educated decision-making. By inputting variables such as car loan quantity, rate of interest price, and term length, individuals can analyze numerous scenarios to select the most affordable alternative tailored to their financial scenario.

Furthermore, clever funding calculators use openness by damaging down the total expense of loaning, consisting of passion repayments and any added costs. This openness equips users to recognize the economic ramifications of obtaining a lending, allowing them to make audio monetary choices. Furthermore, these tools can conserve time by supplying immediate computations, removing the demand for hand-operated calculations or intricate spreadsheets.

Functions of the Tool

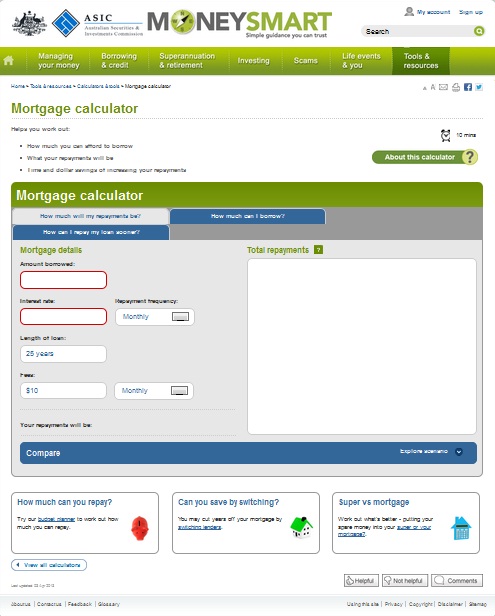

The tool integrates a straightforward interface developed to enhance the procedure of analyzing and inputting lending information successfully. Users can quickly input variables such as lending quantity, rates of interest, and funding term, permitting for fast computations of regular monthly repayments and total rate of interest over the funding term. The device also supplies the flexibility to adjust these variables to see how adjustments impact the total lending terms, equipping customers to make enlightened financial choices.

Additionally, the clever finance calculator supplies a breakdown of each month-to-month settlement, revealing the part that goes in the direction of the principal quantity and the passion. This attribute helps individuals imagine just how their settlements contribute to repaying the lending over time. Moreover, users can generate in-depth amortization routines, which describe the settlement schedule and passion paid monthly, aiding in long-lasting economic preparation.

Exactly How to Make Use Of the Calculator

In navigating the lending calculator effectively, individuals can conveniently take advantage of the straightforward interface to input key variables and produce useful economic insights. Customers can also specify the settlement regularity, whether it's monthly, quarterly, or yearly, to straighten with their financial preparation. By adhering to these simple steps, customers can efficiently utilize the lending calculator to make informed monetary decisions.

Benefits of Automated Calculations

Automated computations enhance financial procedures by swiftly and accurately computing intricate figures. One of the essential benefits of automated calculations is the reduction of human mistake. Hand-operated computations are prone to mistakes, which can have substantial next implications for monetary choices. By utilizing computerized devices, the risk of mistakes is minimized, making certain better precision in the results.

Moreover, automated estimations save time and increase effectiveness. Complicated monetary computations that would usually take a considerable amount of time to complete by hand can be carried out in a fraction of the moment with automated devices. This permits economic professionals to focus on examining the results and making notified decisions instead of investing hours on computation.

This uniformity is vital for comparing various monetary situations and making sound monetary options based on exact data. home loan calculator. On the whole, the advantages of automated estimations in simplifying monetary procedures are obvious, supplying raised accuracy, effectiveness, and uniformity in complex financial computations.

Enhancing Financial Preparation

Enhancing financial planning entails leveraging advanced tools and techniques to enhance monetary decision-making processes. By using advanced financial preparation software application and services, individuals and calculators can gain much deeper insights right into their financial health and wellness, established reasonable goals, and create actionable plans to achieve them. These tools can analyze different financial circumstances, job future results, and provide referrals for efficient riches administration and danger reduction.

Additionally, enhancing monetary preparation incorporates incorporating automation and synthetic intelligence right into the process. Automation can enhance regular monetary jobs, such as budgeting, cost monitoring, and investment monitoring, liberating time for calculated decision-making and evaluation. AI-powered devices can offer tailored economic advice, determine fads, and recommend ideal investment possibilities based upon individual threat accounts and monetary objectives.

In addition, cooperation with monetary experts and experts can boost economic preparation by providing valuable insights, industry understanding, and customized strategies tailored to particular financial objectives and conditions. By integrating advanced tools, automation, AI, and expert suggestions, people and organizations can elevate their economic preparation abilities and make informed decisions to secure their financial future.

Verdict

In verdict, the wise finance calculator service uses countless advantages and functions for streamlining economic calculations - home loan calculator. By utilizing this device, customers can conveniently calculate finance payments, passion prices, and payment routines with precision and performance. The automated calculations provided by the calculator go to my site boost economic planning and decision-making procedures, inevitably resulting in much better financial monitoring and educated options

The smart funding calculator solution is designed to simplify your monetary estimations, offering a smooth have a peek at this site method to analyze and plan your fundings. Generally, the advantages of automated estimations in simplifying monetary processes are indisputable, offering enhanced precision, efficiency, and consistency in complicated financial computations.

By using innovative monetary preparation software and services, people and calculators can gain deeper understandings into their economic health and wellness, established sensible objectives, and create actionable plans to accomplish them. AI-powered tools can offer tailored financial recommendations, identify patterns, and suggest optimal investment chances based on individual risk accounts and economic purposes.

Report this page